Asian shares rose on Wednesday and European stocks looked set for gains after US President Donald Trump said negotiators were close to inking an initial trade deal, while expectations the Federal Reserve will keep rates low underpinned sentiment.

Trump's upbeat comments on trade stoked confidence in Asia, with MSCI's broadest index of Asia-Pacific shares outside Japan up 0.29 percent. Australian shares added 0.93 percent and Japan's Nikkei rose 0.39 percent.

In Europe, pan-region Euro Stoxx 50 futures were up 0.16 percent, at 3,710, German DAX futures gained 0.16 percent to 13,262.5 and FTSE futures rose 0.1 percent to 7,412.

Chinese blue-chip shares, in contrast, dropped 0.21 percent after the data showed profits at China's industrial firms declined in annual terms for the third consecutive month in October. The decline tracked sustained drops in producer prices and exports and underscored slowing momentum in the world's second-largest economy.

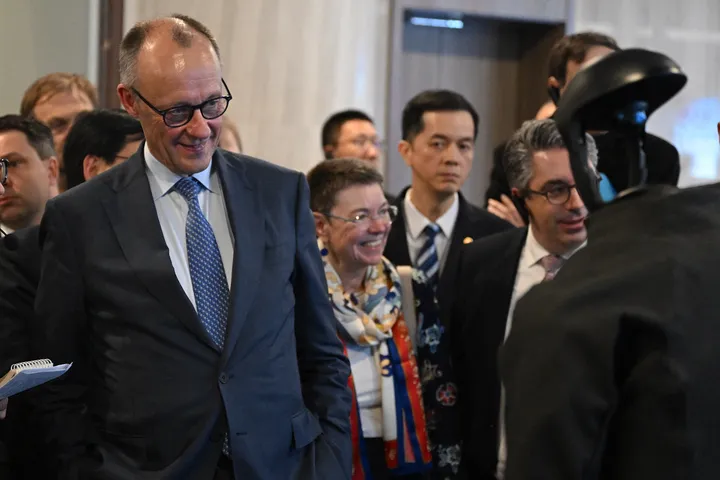

US and China to agree on first phase of trade deal

Trump said on Tuesday the US and China are close to an agreement on the first phase of a trade deal after top negotiators from the two countries spoke by telephone and agreed to keep working on remaining issues.

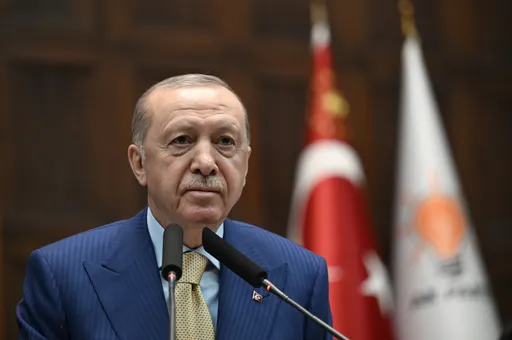

The positive mood pushed Wall Street indexes to fresh record closing highs on Tuesday. But while Trump said Washington was in the "final throes" of work on a trade deal with Beijing, he also underscored US support for protesters in Hong Kong, seen as a sore point for Beijing.

Trump's comments came alongside softer-than-expected economic data from the US, which showed a fourth straight monthly contraction in consumer confidence and an unexpected drop in new home sales in October.

However, consumer confidence still remained at levels able to support steady consumer spending and the housing data for September was revised up, with purchases touching more than 12-year highs.

Kay Van-Petersen, global macro strategist at Saxo Capital Markets in Singapore, said while US-China trade headlines may be driving some tactical, near-term moves in the market, they were mostly just "noise".

The broader market direction is "about the accommodative Fed and accommodative monetary policy and the fact that structurally the meta-trend is still lower in yields and rates", he said.

Looking beyond trade to explain rising equity prices

Some analysts said a fall in US bond yields on Tuesday also pointed to more mechanical explanations beyond trade for rising equity prices.

"It reinforces the notion that it really is the Fed pump-priming to grease the wheels of market liquidity, which is driving both these moves," Greg McKenna, strategist at McKenna Macro, said in a morning note.

Fed Chair Jerome Powell said on Monday monetary policy was "well positioned" to support the strong US labour market.

On Tuesday, the Dow Jones Industrial Average rose 0.2 percent to 28,121.68, the S&P 500 gained 0.22 percent to 3,140.52 and the Nasdaq Composite added 0.18 percent to 8,647.93. All three indexes notched record closing highs.

On Wednesday, the rally in US treasuries moderated across the curve, with benchmark 10-year notes yielding 1.7431 percent, up from their US close of 1.74 percent on Tuesday.

The two-year yield, watched as a guide to market expectations of Fed policy, rose to almost 1.6 percent compared with a US close of 1.586 percent.

In currency markets, the dollar strengthened 0.11percent against the yen to 109.15 and the euro weakened 0.08 percent to buy $1.1009.

The dollar index, which tracks the greenback against a basket of six major rivals, was up 0.09 percent at 98.341.

Oil prices retreated after rising Tuesday on reassuring trade headlines. US West Texas Intermediate crude was down 0.21 percent at $58.29 per barrel.

Global benchmark Brent crude lost 0.11 percent to $64.20 per barrel.

Gold was lower, changing hands at $1,458.33 per ounce on the spot market, down 0.2 percent.