US household debt rose around 1 percent quarterly in the third quarter of this year, reaching an all-time high of $18.6 trillion, according to data released by the Federal Reserve Bank of New York.

Household debt climbed by $197 billion in the third quarter of the year compared to the previous quarter, data showed on Wednesday, while it was up by $642 billion on an annual basis.

Mortgages continued to account for the largest share of American household debt, rising to $13.07 trillion in the third quarter.

Housing debt was up by $137 billion in the third quarter compared to the previous quarter and climbed by $478 billion year-on-year.

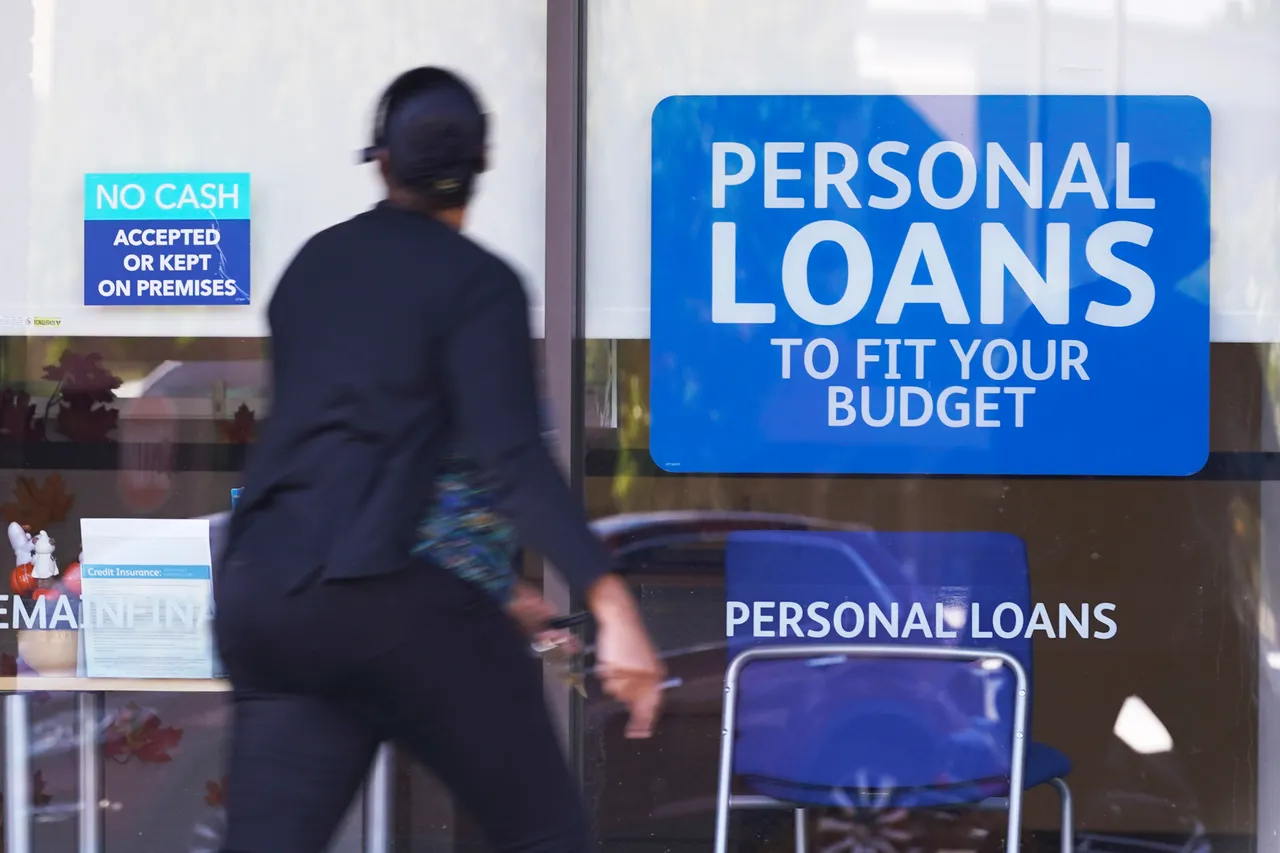

Other items, including auto loans, incurred the most debt among Americans during this period, totalling $1.66 trillion.

Increase in young borrowers, credit card debts

During a briefing with reporters on Wednesday, New York Fed researchers said household balance sheets remain “pretty strong,” though younger borrowers show some signs of strain.

Meanwhile, student loan debt rose to $1.65 trillion and credit card debt increased to $1.23 trillion, both hitting record highs in the third quarter.

Nearly 10 percent of all student debt was reported as 90 days delinquent or more.

During this period, credit card debt increased by $24 billion compared to the previous quarter, and student loan debt was up by $15 billion.

Meanwhile, auto loan debt remained stable during the same period.

According to the US Census Bureau, the size of the population over the age of 18 comes to around 265 million. That would mean each adult American owes a debt of around $65,000.