The future of US sanctions on Venezuela has suddenly moved to the frontline of geopolitics after the abduction of President Nicolas Maduro by the US military.

Washington’s announcements before its dramatic operation against Maduro on Saturday, including a US blockade of sanctioned oil tankers and calls for American energy firms to invest in Venezuela’s oil sector, signal continuity and potential change in sanctions policy.

However, it remains unclear whether these moves will bring meaningful relief to Venezuelan citizens or mainly benefit US oil interests.

Sanctions focused on oil economy

For years, US sanctions have crippled Venezuela’s oil exports, once the backbone of the South American country’s economy. The ongoing embargo, reinforced under the Trump administration, blocks most oil shipments and targets tankers transporting sanctioned Venezuelan crude, shutting down exports effectively.

This has pushed Venezuela’s production to historic lows and strained public finances. Only a limited Chevron licence has allowed some output to continue, but the broader sanctions regime has remained firmly in place.

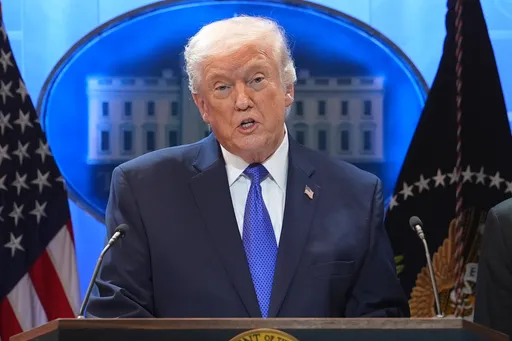

US President Donald Trump has publicly linked the capture of Maduro to America’s long-standing interest in Venezuelan oil, asserting that US companies will rebuild the nation’s deteriorated energy infrastructure and restore production, potentially spending billions in the process. But experts warn that political instability and decayed facilities mean any recovery would take years and huge investment, far from an immediate boon for Venezuelans’ daily lives.

US sanctions policy is a central determinant of Venezuela’s oil production outlook. Analysts from financial firms like Goldman Sachs note that production could remain flat or grow only modestly in the near term, depending on how Washington adjusts sanctions and how investors respond to legal and political risks.

This suggests that even if sanctions shift, the immediate impact on Venezuela’s economy could be limited.

Sanctions relief?

Washington might ease restrictions on oil exports in exchange for political and economic concessions from Venezuela’s interim authorities or a successor regime.

Such a move could attract foreign capital and technology, boosting production and generating government revenue that could be used to address shortages of food, medicine and basic services.

However, an immediate lifting of sanctions appears unlikely without clear political stability and enforceable contracts as many US oil firms, interested in Venezuela’s vast reserves, remain cautious amid ongoing political uncertainty.

Legal complexities around ownership of Venezuelan oil assets and compliance with international law further complicate the situation.

Conditional path

A more likely outcome is a gradual easing of sanctions tied to specific benchmarks, such as restructuring the oil sector or forming a transitional political arrangement.

Supporters say this approach could balance US interests with Venezuela’s recovery, though it would deliver slow and uneven results for citizens struggling with daily hardships.

As Washington considers its next steps, the future of US sanctions will shape how Venezuela’s oil sector is rebuilt and who benefits from that process.

For many Venezuelans facing persistent economic hardship, any policy shift will be judged not by investment pledges, but by whether it delivers tangible improvements in daily life.